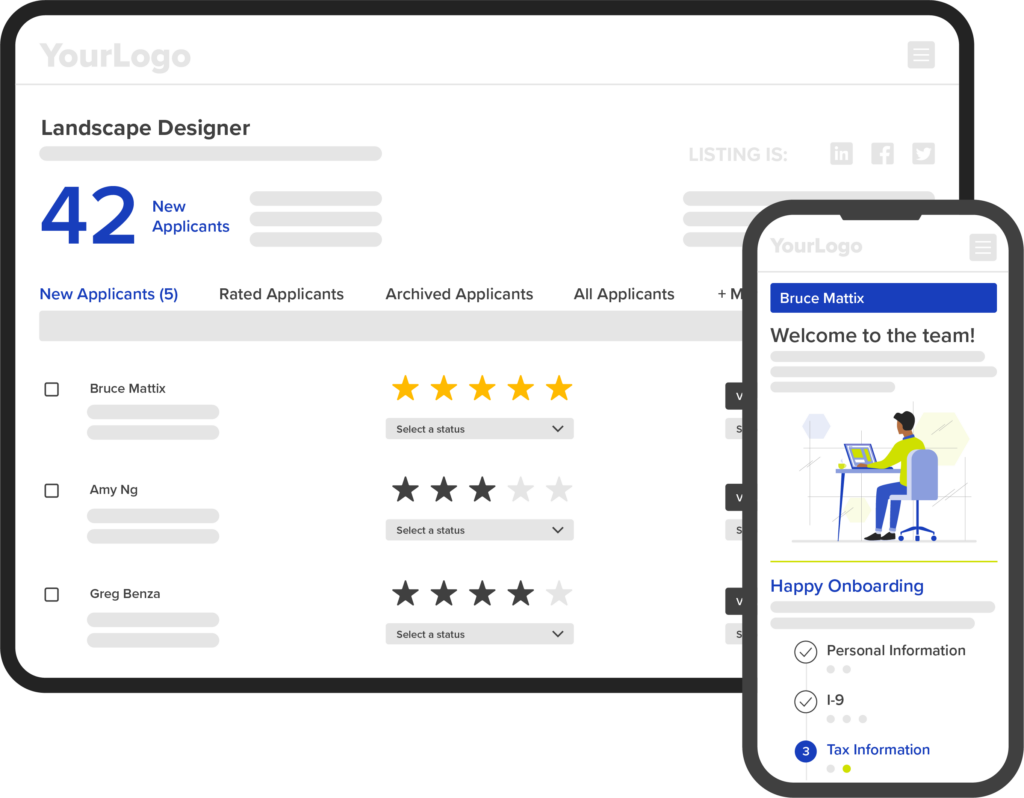

Modern recruiting and employee onboarding platform as a service

Lead the market and grow revenue by partnering with HiringThing to embed AI-powered, customizable, and fully supported talent solutions.

Partner Perfection™ for you and Hiring Happiness® for your clients

Add talent software to your solution

Our approachable, adaptable hiring and employee onboarding platform enables you to choose which proprietary talent solutions you offer to the businesses you serve. A step beyond white label, our platform can be shaped to meet your unique solution needs.

White label and beyond

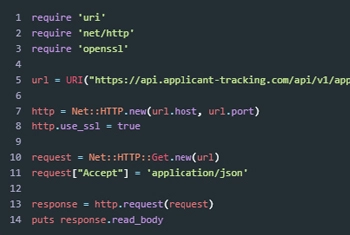

Developer tools and resources at the ready

Integrate in a flash. Our Open API, documentation, and experts are at your fingertips to get you integrated fast.

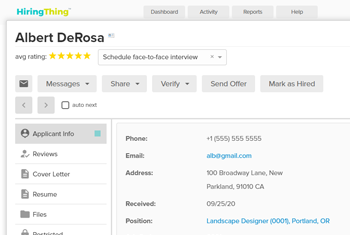

Integrated hiring is harmonious hiring

Connect the networks and systems you love most to create a single-source recruiting and onboarding platform.

AI-powered talent platform

Add an intuitive, advanced talent software to your solution without the stress of building it yourself.

Our Story

HiringThing was founded on the premise that hiring should be a streamlined, engaging, enjoyable experience for employers and job seekers. HiringThing set about building a hiring platform they wanted to use.

Through market research and evaluation, our team recognized a gap. We evolved the platform to be a modern, easy-to-use, and open recruiting and onboarding system. Our white label partnership allow organizations to partner with us to present their talent solutions as a proprietary platforms used to increase revenue, reduce customer churn, expand their team, and ultimately deliver Hiring Happiness®.

The latest in recruiting trends and technology on the Talent Tech Hub

PRIVATE LABEL

Embedded Hiring is the Next Embedded Fintech

Embedded fintech has revolutionized how financial solutions are brought to customers. Embedded hiring is poised to be next.

PRIVATE LABEL

Aspire to Be Multiproduct

There are many benefits to offering multiple products under one roof. Here’s why SaaS platforms should add to their solutions.